From Zimbabwe to Wall Street with help from FIU Mentor.

Enia Gyan (BBA ’09) arrived at FIU from Harare, Zimbabwe with dreams of becoming an architect. But it was a finance class taught by Marcos Kerbel, a distinguished banker and longtime assistant teaching professor of finance that would chart an entirely new course for Gyan and lead to a successful career in banking law and corporate finance.

Now an associate in the New York office of global law firm Fried Frank, Gyan credits Kerbel’s teaching and mentorship for sparking her interest in finance and instilling lifelong values of leadership and integrity.

“I really loved his message on integrity,” Gyan said. “He used to say, ‘If you’re a chief executive without integrity, you’re just a chef that’s going to cook the books.’ That stuck with me. I realized then that sophistication means nothing if you don’t have ethics behind it.”

Gyan switched her major to finance after taking Kerbel’s commercial banking course. She recalled how captivating his course was- from learning about the long history of banking to the structure of bank balance sheets, he transformed her outlook.

After graduating with honors from FIU, Gyan landed her first corporate job as a bank examiner thanks to an opportunity she says came about after Kerbel recommended her to a contact at the State of Florida’s Office of Financial Regulation.

“Professor Kerbel has worked with many bankers and regulators in South Florida for decades,” said Gyan. “For me to have been able to benefit from his extensive business network and learn of opportunities that I would have not known of otherwise is pretty incredible and something I’m very grateful for.”

Her time as a bank examiner inspired her to go to law school after witnessing the complex legal and regulatory processes behind bank failures and closures. That experience eventually led her to represent financial institutions and borrowers in high-stakes corporate finance transactions both in the U.S. and internationally.

But Gyan’s connection to FIU and Kerbel didn’t end with graduation. The two remain in close contact, and she recently returned to campus to speak to students in his banking class.

“To me, FIU and Miami will always be home,” Gyan said. “When I’m in Miami, I feel accepted, connected and celebrated.”

Her advice to current students? “Be present. Be a sponge. Build credibility by doing good work. And stay connected—you never know where any one relationship will take you.”

Gyan’s story is a testament to the power of mentorship, resilience and the lasting impact of a university community that believes in its students. “There’s no substitute for time,” Gyan said. “At FIU, the time I spent and the people I met have shaped the trajectory of my entire career.”

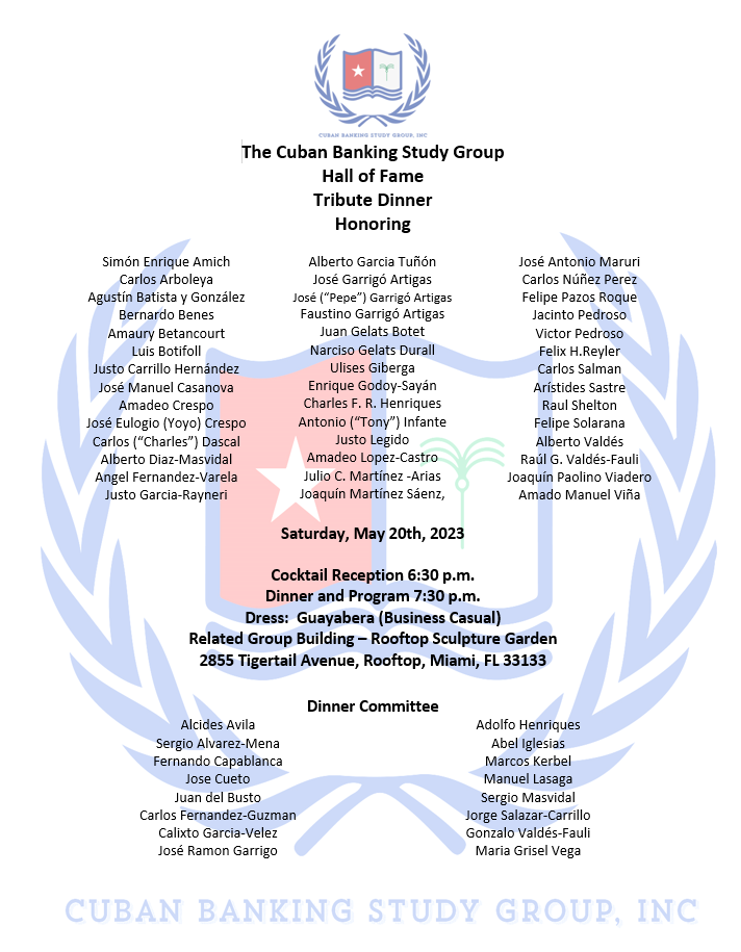

CBSG – Will Hold a Tribute Dinner to Honor the Inductees to the Cuban Bankers’ “Hall of Fame”

CBSG SIGNS MOU WITH CASA CUBA AND FIU

On April 23, Directors of the Cuban Banking Study Group (“CBSG”) met with top executives of Florida International University (“FIU”) and CASA CUBA to execute a Memorandum of Understanding (“MOU”) providing for close cooperation in their future endeavors. FIU was represented by President, Dr. Mark Rosenberg and by its Provost, Kenneth Furton. CASA CUBA was represented by its Executive Director, Maria Carla Chicuen. Fernando A Capablanca, President of CBSG signed the MOU on behalf of the organization which was well represented by many of its Board members.

According to Capablanca “the MOU is designed, among other things, to establish and explore the current and emerging educational needs of FIU students and the community at large regarding the history and future development of the Cuban banking system by utilizing the experience of our members. In addition, it gives us the opportunity to create a Cuban Bankers Hall of Fame within CASA CUBA to honor those in our industry who have distinguished themselves in Cuba and internationally.”

“CBSG and CASA CUBA recognize the compatibility of their institutional missions and look forward to a mutually profitable relationship in the coming years.”

SEATED LEFT TO RIGHT:

Maria Carla Chicuen, Executive Director, CASA CUBA

Fernando A Capablanca, President CBSG

Mark Rosenberg, President FIU

Dr. Jorge Salazar-Carrillo, FIU Professor

STANDING LEFT TO RIGHT

Marcela Perez de Alonso, guest

Maria Grisel Vega, Bci Bank

Jose Ramon Garrigo, VP of CBSG

Manuel Lasaga, FIU Professor

Kenneth Furton, Provost FIU

Juan del Busto, Del Busto Capital Partners

Marcos Kerbel, FIU

Professor Maite Morales, Casa Cuba

Lydia Betancourt FIU Foundation.

La Pandemia y la Banca en Cuba, May 4, 2020

Document presented May 4, 2020, by Fernando Capablanca, CBSG President, at Florida International University (FIU) Casa Cuba.

Kenneth Rogoff makes presentation about Central Banks Independency

From left to right: Abel Iglesias, Jorge Salazar-Carrillo, Fernando Capablanca, Kenneth Rogoff, Alcides Avila, Juan del Busto, Grisell Vega, Marcos Kerbel, Sergio Alvarez Mena

On December 3, 2019, Kennet Rogoff was invited by the Cuban Banking Study Group (CBSG) to make a presentation and share his opinion on “The Beginning of the End of Central Bank Independence and its Implication in LATAM and Cuba.”

Rogoff is Thomas D. Cabot Professor at Harvard University and from 2001-2003 served as Chief Economist at the International Monetary Fund. He is known for his seminal work on exchange rates and on central bank independence. He has authored various books on economic subjects, including “The Curse of Cash,” arguing that although much of modern macroeconomics abstracts from the nature of currency, it in fact lies at the heart of some of the most fundamental problems in monetary policy and public finance. Rogoff is an elected member of the National Academy of Sciences, the American Academy of Arts and Sciences, and the Group of Thirty. He is a senior fellow at the Council on Foreign Relations, ranked among the top ten on RePEc’ s ranking of economists by scholarly citations.

The Rogoff presentation was attended by CBSG Directors and members, and local bankers. Among many other questions the participants inquired about the supposed independence of the Central Bank of Cuba and countries of government-controlled economies. Fernando Capablanca, CBSG President, affirmed that “This is a continuation of the education and services provided to our membership.”

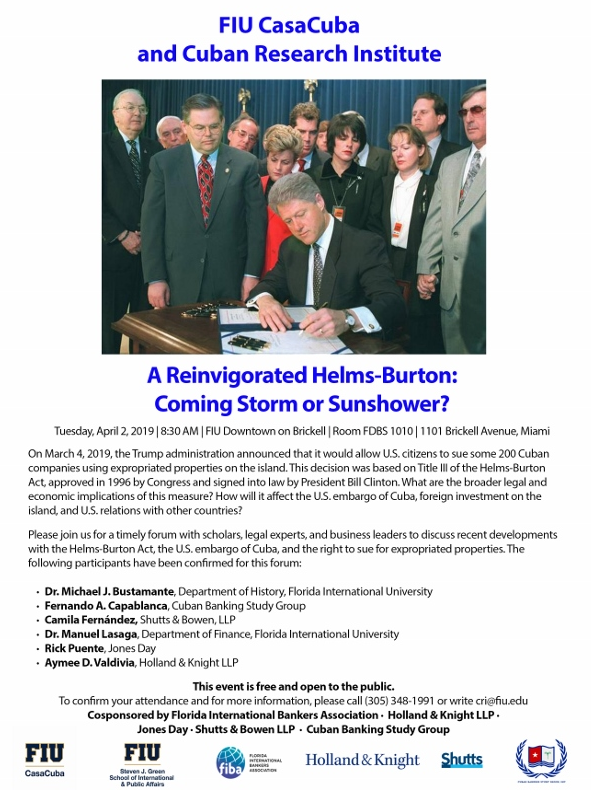

A Reinvigorated Helms-Burton Coming Storm or Sunshower?

Fernando Capablanca making a presentation on “A Reinvigorated Helms-Burton: Coming Storm or Shower?

Cuban Banking Study Group Celebrates 25 years

On December 6, 2017, the Cuban Banking Study Group (CBSG) celebrated its 25th anniversary with a reception and dinner at the Big Five Club in Miami, Florida. About 140 persons participated in the event. “We were delighted to see so many bankers and friends joining us for this event. It was better than we had envisioned,” said José R. Garrigó, CBSG Vice President and Treasurer.

During the event, CBSG President, Fernando Capablanca, presented awards to those Directors that have served continuously for 25 years. In addition, the deceased Directors were also mentioned. “It is important to remember those who preceded us and who dedicated many years to helping us get to where we are today. We owe it to them never to forget their memories and their contributions,” said Capablanca.

Following the dinner, Capablanca made a short presentation tracing the history of the Cuban banking and financial systems from their inception in 1832 to their current composition. He again emphasized that “Cuba had a robust financial system in the decade of the 1950s where Cuban-owned banks controlled over 80% of the assets and deposits. CBSG believes that an indigenous banking industry, ready to serve the needs of local communities and small businesses, working together with government-owned institutions, foreign banks and multinational agencies is critical to Cuba’s future economic development. CBSG strives to promote and engage in a consultative approach to ensure this transition is achieved.”

Both Capablanca and Garrigó have argued for years that private Cuban-owned banks must be encouraged, given special considerations and allowed to flourish in any future environment as a predicate for economic growth and diversity.

Director Steven Harper followed with a presentation summarizing the recent changes made by the Office of Foreign Assets Control (OFAC) under the Cuban Sanctions Program.

Fernando Capablanca, CBSG Chairman, presenting awards to Founding Directors and other Board members.

Left to right: José R. Garrigó, Victoria F. Garrigó, Fernando Capablanca and Sara Maymir.

Partial view of attendees at CBSG 25th Anniversary Dinner.

Initial Board of Directors – 1992

Standing, left to right: Enrique Llaca, Oscar Bustillo, Jorge Salazar-Carrillo, Gonzalo Valdés-Fauli, Carlos Fernández, Raúl Shelton, Jorge Arguelles, Sergio J. Masvidal.

Seated, left to right: José R. Garrigó, George R. Harper, Fernando Capablanca, Manuel Lasaga.

PUBLICATIONS

CUBA – PAST PRESENT AND FUTURE OF ITS BANKING AND FINANCIAL SYSTEM

(An addendum updating the information will be ready by the end of 2018)

FEATURED ARTICLES

Miami Hearld – American & Cuban Bankers Hold Historic Meeting